-

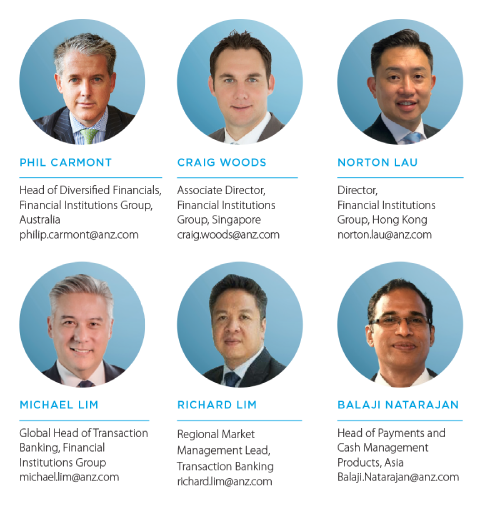

Phil Carmont (Head of Diversified Financials, Financial Institutions Group, Australia)

Craig Woods (Associate Director, Financial Institutions Group, Singapore)

Norton Lau (Director, Financial Institutions Group, Hong Kong)

Michael Lim (Global Head of Transaction Banking, Financial Institutions Group)

Richard Lim (Regional Market Management Lead, Transaction Banking)

Balaji Natarajan (Head of Payments and Cash Management Products, Asia)As the industry moves inexorably to a seamless, always-on payments and clearing ecosystem, it is imperative that financial institutions stay abreast of clients' evolving needs.

The advent of challenger banks and fintechs has placed considerable competitive pressure on traditional financial institutions and their payments and clearing systems, especially, as customer demands grow for convenient, transparent and real-time transactions that can cope with the ceaseless nature of the global business environment.

In response to these challenges and the need to keep pace with the march of technology, many established players in the Asia Pacific region have opted to partner with fintechs while others have shaved margins off products to ensure they do not get left behind.

As Richard Lim, Regional Market Management Lead, Transaction Banking, puts it: “The challenge for traditional financial institutions is to become much faster and more efficient in providing the offerings customers need. It’s all about staying relevant and serving customers as well as the new entrants, if not better.”

Disruptive Fintechs - Landscape

Fintech (Financial technology) is used to describe companies that leverage new disruptive technology to enhance customer experience, optimise the delivery of financial services and expand the customer base to include under-served segments

Payment Tech

- Ranges from digital wallet, payment platform to digital currencies.

- Leverages latest technologies like smart phones, blockchain, AI/ML for automation, straight through processing, and Big Data analytics to enable payments.

- Lower Transaction costs reduces friction using technology solutions for value transfer.

Select subcategories and examples - Digital wallet makes payments faster, simpler and secure.

- Digitising credit/debit card allows users to make payments with QR codes and NFC enabled smart devices.

- Create a new payment ecosystem by issuing digital currency.

- Smart contract based applications promote digital currency usage.

- Hardware and software tools for merchants to accept digital payments at low cost.

Credit Tech

- Streamlining risk assessment and speeding up loan approval processes.

- Track social media and online purchasing behaviour to supplement traditional data for risk modelling.

- Serve unserved/under-served populations.

Select subcategories and examples - P2P lending enables individuals to obtain loans directly from other individuals, cutting out the financial intermediaries.

- Lending also done in digital currencies.

- Credit management platform providing credit score, reports and credit score simulator.

- Cloud-based platform for invoice factoring that enables rapid advances on outstanding invoices for SMEs.

Investor Tech

- Innovative electronic trading platforms facilitate online trading at low to nil cost.

- Social trading networks allow investors to replicate peers and expert traders.

- AI-powered or data driven personalized wealth management services, including Robo-advisory.

Select subcategories and examples - AI-powered or Data driven personalised wealth management services and technology.

- Create or replicate investment strategies in client portfolios without need to bind them in funds or structured products.

- Low to nil commission trading platform with access to a wide range of global securities.

- “Mobile first” approach for trading platforms.

- Analytics, goal based planning and portfolio reporting for investment advisors.

Customers demand, technology provides

In order to do that, banks are turning to technology and leveraging the significant advancements seen in products, services and industry support over the past five years to “improve customer experience, speed of execution, ease of access and visibility of payments, while flattening costs and making them more transparent,” noted Michael Lim, ANZ’s Global Head of Financial Institutions, Transaction Banking. “Accessibility is particularly important because telling a customer that they cannot make an international payment unless they do it before 11am is no longer acceptable.”

Another key area of improvement is the faster receipt and reconciliation of funds into users’ accounts. This is vital to the customer experience because delays can hold up the allocation of fund units or the commencement of insurance coverage.

An industry example of customer expectations driving changes in the payment space can be observed in the evolution of the wealth management sector. The shift towards mass retail wealth from Institutional and High Net Worth investors has impacted the wider ecosystem traditionally dominated by private banks and wealth managers. “What we are seeing is online brokers, as the new entrants, provide seamless customer experience in the buying and selling of investment securities akin to digital banking services. If we consider a client in Asia, a focus of theirs is to be able to access investment opportunities outside the region, requiring timely and transparent movement of money across countries. This in turn is expected to drive cross-border real time payment and reconciliation initiatives that would be of much interest to the broker segment”, said Craig Woods, Associate Director in the ANZ Financial Institutions Group in Singapore.

In Australia, there has been an emergence of fintech competitors in retail share broking who provide a low cost service and an attractive digital interface but they outsource the traditional execution and settlement activities to third parties. “These fintechs, who are not actually licensed equity brokers, have attracted retail investors during the COVID period at a rate that is becoming a concern for the established retail brokers. While the established players doubt that the budget pricing is sustainable, they also feel a growing need to imitate the digital user experience and this extends to enhanced payments functionality such as in-bound real time payments”, said Philip Carmont, ANZ’s Head of Diversified Financials, Financial Institutions Group in Australia.

Live Real Time Payment (RTP) system in ANZ footprint with PCM offerings

Australia

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

New Payments Platform (2018)

AUD

Cross border transactions to be available from Dec 2022.

China

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

Internet banking payment system (2010)

CNY

Introduced NUCC -t support interoperability between wallets (alipay/wechat/jd etc. and banks) in 2019. Pilot of CBDC.

EU

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

SEPA instant credit transfer (2017)

EUR

Cross border transactions enabled across 20 countries in Europe.

Hong Kong

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

Faster Payment System (2018)

HKD & CNY

N/A

India

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

Immediate Payment Service (2010)1

INR

UPI (overlay on IMPS) is linked to Singapore’s NETS to facilitate the Indian remittance corridor. Plans to link with RTPs of UAE, Malaysia and Myanmar.

Indonesia

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

Planned, targeted for 2021-’22 (BI-FAST)

IDR

N/A

Japan

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

Zengin system (1973)2

JPY

N/A

Philippines

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

InstaPay (2018)

PHP

Possibility of linking to other ASEAN RTPs.

Singapore

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

Fast and Secure Transfers (2014)

SGD

PayNow (overlay on FAST) is linked with Thailand’s PromptPay and also has plans to link with Malaysia’s DuitNow.

Thailand

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

PromptPay (2016)

THB

Linked with Singapore’s FAST and also has plans to link with Malaysia’s DuitNow.

UK

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

Faster Payment Service (2008)

GBP

Cross border transactions through SWIFT gpi instant connection.

Vietnam

Live RTP Systems

(Active year)Currencies

supportedCross border linkage

QUICK (2020)3

VND

N/A

1 Payment systems being opened up for non bank players to participate.

2 Zengin upgrade (7G) in 2018/2019 becoming 24/7 and high throughput. It is being opened for non-bank (non deposit-taking institutions) from 2021. https://www.zengin-net.jp/en/announcement/

3 Retail transfersWhen will we see real-time cross-border payments?

There has been considerable progress in introducing real- time local payments platforms across Asia Pacific. Australia has launched the New Payments Platform (NPP), Singapore has its Fast & Secure Transfer (FAST) network while Hong Kong has its Faster Payment System (FPS). Several other jurisdictions are developing similar systems of their own. But there is less clarity on when we might see real-time cross border payments come to the region.

One potential solution is SWIFT’s global payments innovation (gpi) initiative, which went live in 2017 and has been successfully trialled in supporting instant cross-border payments involving banks in Australia, China, Thailand and Singapore. But commercial adoption faces two hurdles, according to Richard Lim.

The first is the regulatory challenge, with banks having to carry out several processes, especially screening, as the payment moves across borders in a matter of seconds. Most banks would need to upgrade their internal systems and capabilities in order to satisfy their compliance obligations. Another problem is the significant divergence of real-time payments capabilities, both domestic and international, of individual countries in APAC.

“Some countries still require a very heavy set of documentation and approvals before each payment can move cross-border. So that is a hurdle that is not technology-based but perhaps could be solved with technology,” said Richard Lim.

“Ahead of a consistent regional solution, which is probably some time away, there have been bilateral efforts, such as Singapore and Thailand planning to connect their domestic real-time payment platforms over the coming months, suggesting we could see more similar arrangements in the interim”, added Richard Lim.

The main question in setting up effective bilateral cross- border payments systems across the region is identifying “the key currencies that customers are actually looking to move,” explained Norton Lau, Director, Financial Institutions Group, Hong Kong at ANZ.

“Some domestic networks in Asia handle the local currency while offering support for other key currencies: e.g. Hong Kong’s Real-Time Gross Settlements supports HK dollar, US Dollar, Euro and Renminbi, while Hong Kong’s FPS supports Hong Kong Dollar and Renminbi,” he added. When domestic systems across the region are interconnected, the speed of the cross-border or cross-currency system will be driven largely by these domestic networks.

Eventually, the SWIFT-dominated system could give way to a “multitude of alternatives, comprised of arrangements amongst central banks connecting domestic networks, involving emerging technologies such as DLT (distributed ledger technology) or Central Bank Digital Currency (CBDC) for Cross Border Settlements,” according to Balaji Natarajan, Head of Payments and Cash Management, Asia at ANZ. The emergence of CBDC might greatly reduce financial institutions’ compliance obligations and settlement risks.

When to buy and when to build?

Clearly, technology is the answer for financial institutions striving to improve their payments and clearance capabilities. The question then is whether they build their own capabilities or seek to license or outsource.

Four or five years ago, the tendency was to build the necessary capabilities in-house, with “many proofs of concepts and experiments taking place,” explained Michael Lim. But many of those attempts - using the likes of DLT - have yet to be commercialised. The lesson for financial institutions here is that “if someone has already built it, there is no point trying to replicate it,” noted Michael Lim.

Outsourcing also allows resource-constrained corporations to spend their investment dollars on areas where they can create greater value, such as improving the customer proposition, stressed Balaji.

But an important caveat in turning to outsourcing is that regulators will continue to expect the Bank to be responsible for the actions of their service providers. “By building in-house, you could provide a very controlled environment. When deciding who to buy or outsource from, the ability to comply with regulatory obligations is a primary criterion,” added Balaji.

Range of digital currencies

Central Bank Digital Currency (CBDC)

- Virtual form of a fiat currency using electronic record or digital token

- Centralized, issued and regulated by the relevant monetary authority of a country

- Generally issued in liability format

- Early stages of development for central banks across the world

Select examples

Details of examples

e-CNY

- e-CNY is a retail non-DLT based CBDC issued by PBoC

- CNY 100m worth of e-CNY issued as of Feb 2021

Decentralised Digital Currency

- Digital asset that relies on cryptography to chain together digital signatures of asset transfers, peer-to-peer networking and decentralization

- Proof-of-work or proof-of-stake scheme used in some cases to create and manage the currency

- Distributed ledger technology employed to achieve decentralization

- Represents the majority of current cryptocurrency volumes

Select examples

Details of examples

Bitcoin

- Issued by unknown person / group of persons

- Decentralised digital currency based on open source software

- Largest cryptocurrency by market cap with valuation of USD 702bn1

- 18.7 mln bitcoins in circulation1

- 21 mln bitcoins upper limit of supply1

Ether

- Issued by Ethereum foundation

- Ether is the native currency of Ethereum, a decentralised open source blockchain with smart contract capability

- 2nd largest cryptocurrency by market cap with valuation of USD 310bn1

- 116.0m ether in circulation with no upper limit of supply1

Stable Coins

- Cryptocurrencies with market value pegged to an external reference

- E.g. may be pegged to a currency like USD or to a commodity’s price such as gold

- Price stability achieved via collateralization (backing) or through algorithmic mechanisms of buying and selling the reference asset or its derivatives

Select examples

Details of examples

JPM Coin

- Issued by JP Morgan Chase

- JPM coin is a permissioned, shared ledger system available only for institutional clients of JP Morgan

- Pegged to USD at 1:1 ratio

USD Coin

- Issued by a consortium of Circle and Coinbase

- An open source, smart contract-based stablecoin with each USD coin backed by a USD held in reserve

- 8th largest cryptocurrency by market with valuation of USD 21bn1

Diem

- Permissioned blockchain-based payment system proposed by Facebook

- Diem Coins are backed by a reserve of assets made up of cash or cash equivalents across multiple currencies

1. Data sourced from CoinMarketCap, as of 27th May 2021.

The value proposition makeover

As financial institutions move to counter the competition and meet changing customer preferences either through building capabilities internally or working with the right fintech partners, banks, such as ANZ, must remain focused on identifying and meeting “specific sector requirements, whether it is brokers, funds or insurance,” advised Michael Lim.

ANZ was among the first banks in Australia to get the NPP fully operational across customer segments, pointed out Balaji, even though “we knew it would require some time to be adopted industry-wide.” Importantly, with its NPP infrastructure already in place, ANZ has commenced building overlay services on top of it.

“We are enabling real-time internal cross border transfers without cut-off times and with instant availability of funds, not just for retail payments but also for large-value transfers, to support our clients especially in the non-bank financial institution space, including funds and insurance,” added Balaji.

Competition or partnership: which will prevail?

As the landscape continues to take shape, Balaji sees ample room for the co-existence of incumbents and challengers alike, likening the ecosystem to a hybrid engine comprised of an agile, electric component, reflecting fintechs, and an Internal combustion engine efficient at running steadily and at scale, representing established financial institutions.

Balaji also observed that more and more markets are opening up to disruptors to directly access all payments systems, therefore partnering with fintechs a necessity while creating synergyistic opportunities for incumbents. For instance, in markets where fintechs are gaining access under open banking regime, that access comes with heavy obligations, and existing players can step in to help fintechs meet their compliance and settlement obligations.

Ultimately, as the market develops, new entrants will likely focus on serving the small and mid-sized enterprises space, “where regulatory forbearance is much greater and cost to serve for incumbents is higher. But the larger enterprises will continue to largely rely on established players due to scale and counterparty risk,” he suggests.

Authors and contacts

To access further economic insights, please subscribe to our research.

Related articles

-

The US tariffs’ impact on China’s growth resembles the shocks that followed COVID-19 and the global financial crisis.

2025-04-23 00:00 -

Expected growth slowdown in the US likely to have impact on Australian consumer, business sentiment.

2025-04-22 00:00 -

Lower US dollar and lower US growth forecast amid tariff-driven uncertainty.

2025-04-17 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.