-

Managing a corporate treasury function is a challenge at the best of times. Even before COVID-19 upended our lives and the global economy, treasurers were preparing to address a host of challenges, ranging from swings in the currency markets to trade tensions, geopolitical and regulatory uncertainty, growing cybersecurity risks, and rapid technological developments. These issues have already widened the competitive gap between those at the forefront of digital transformation and those lagging behind.

The pandemic has further complicated the job of being a treasurer. It has added a fresh sense of urgency around upgrading key functions like cashflow forecasting and working-capital management, as well as risk assessment and business continuity planning.

In response, companies and CFOs that had begun digitising their operations long before COVID-19 have tightened their embrace of technology as they cope with an array of new and unforeseen challenges.

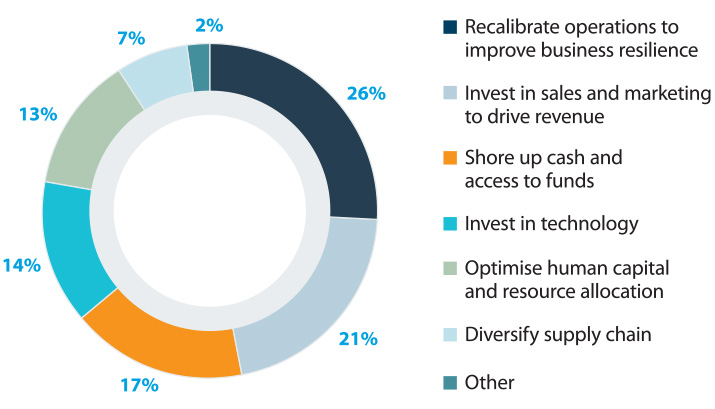

Top Strategic Priorities Globally for CFOs in 2021

Source: 2021 CFO Insights SurveyChoosing the right technology and making it deliver on an operational level is an experience not without obstacles. Banking and technology partners can be a valuable resource to turn to. The right partners can be well-placed to provide assistance as advisors with deep cross-industry expertise, and as a sounding board for ideas.

They can also be a source of operational support, be it in the form of credit lines, providing advice on the latest market trends, or helping to access digital tools and solutions best fit for specific customer circumstances. An open, collaborative discussion with fellow treasurers is another effective way to source insights and learn from the experiences of others.

This article summarises the insights from senior treasurers participating in a series of four roundtables hosted by ANZ over 12 months between 2020-21. These interactions – organised during the height of the pandemic and in subsequent months when the world slowly started to emerge from the crisis – offer a window into the experience of digitising the treasury and provide suggestions for successfully making the transition to a digital future.

The need for agile decision-making

The pandemic created a volatile business environment which jeopardised the revenue streams of many businesses virtually overnight. Along with the challenges of managing teams in a remote-working setting, treasurers also faced an increase in cashflow mismatch risks, which highlighted the need to enhance their forecasting capabilities and better manage liquidity.

Aggressive cost-cutting became the norm with businesses having to jettison key projects midstream and sever ties with consulting partners. At the same time, stubbornly low interest rates meant treasurers struggled to find suitable income-generating options to park their large short-term cash holdings.

In their quest for options to deploy excess cash reserves, finance managers considered strategic acquisitions while remaining wary of making hasty decisions under pressure.

Treasurers also found themselves weighing the pros and cons of using excess funds to pay off suppliers early while balancing concerns of being perceived as overexploiting practices such as early-pay discounts or setting a bad precedent for future payment terms.

On the other hand, a number of positive developments have emerged from the disruption. Experts have told ANZ the pandemic exposed weaknesses in their supply chain and business continuity programs that may otherwise have gone undetected.

This forced them to make difficult yet necessary adjustments to their operations. These included overhauling longstanding legacy payment channels or, in the case of one expert, initiating an operation to streamline costs that eventually helped transform their company into a cash-flow positive business.

"Cash management, visibility and cash forecasting are a core part of every treasury, enabling businesses to have the cash in the right place, at the right time and in the right currency," Tim Ellem, Group Treasurer, EBOS Group Limited said.

"COVID-19 has extended this to include insights on your customers and suppliers so that all stakeholders are treated fairly, but commercially, and all parties remain viable."

These experiences, the panelists observed, collectively highlight the need for businesses to develop a high degree of flexibility and learn the art of quick decision-making in order to adapt to a rapidly evolving business environment and make the most of the opportunities afforded by the economic growth expected to follow in the wake of the pandemic.

Growing focus on managing inefficiencies

One component of the global business environment that has challenged the adaptability being developed by businesses in response to the pandemic is the global supply chain, which has come under severe strain over the past 18 months.

With the cost of shipping goods from one part of the world to another touching record highs and no relief in sight until at least early 2022, the stakes for managing trade flows and the associated risk up and down the value chain have been significantly raised.

From a treasury manager’s point of view, the pandemic has made the generation and preservation of cash a greater priority than turning a profit, and exacerbated the inefficiencies of supply chains dependent on paper documents.

Panelists in the ANZ roundtable discussions drew attention to the growing demand for intuitive digital solutions better suited to accommodate varying levels of technological expertise among senior management as well as multi-country operations where authorised signatories may be located in different locations.

Furthermore, as credit-management tools such as factoring and reverse factoring have gained favour across certain supply chains, they are impacting the liquidity management processes of large suppliers. In turn, supply chain finance (SCF) programs are receiving renewed attention, with proponents describing them as a win-win option that enhances earnings by allowing suppliers to lower their cost of capital and, consequently, their prices.

Conversely, some view it as potentially damaging to a company’s reputation because it creates a perception cash-constrained suppliers may be called upon to agree to unfavourable terms in business dealings.

Nonetheless, for supply chain finance to work effectively, it is critical to ensure close collaboration between a company’s finance and procurement teams, as well as choose the right SCF provider who is well-recognised in a specific market and has established relationships with the suppliers.

Getting digital transformation right

As a means of building greater levels of agility and resilience, and the capabilities to address these issues effectively, companies and their treasuries are working with a select circle of banking partners to digitise their cash management operations.

"Technology is a core piece of the treasury puzzle, especially at a time when head count growth continues to be constrained but the needs of your customers (internal and external) continue to grow," Ellem said.

While some are reviewing and upgrading legacy enterprise resource planning (ERP) systems or considering building ‘data lakes’ – a centralised repository that enhances access to information from various systems and helps improve the accuracy of forecasts – others are looking to implement a model featuring a centralised cash management ‘hub’ with operational ‘spokes’ in core regions.

The choice usually depends on where a company is in the efficiency management journey, with organisational restructuring typically preceding major treasury and finance infrastructure upgrades.

“All processes have the ability to be automated, increasing efficiency in terms of speed and accuracy, thus allowing time to be spent on more value-added activities,” Marlon Singh, Manager Treasury Operations, BHP said.

Further, to ensure time-sensitive transactions such as debt refinancings do not get held up, e-signatures are fast becoming a top priority for companies who are now calling on banks to help implement industry-wide standards and eliminate inconsistencies in the types of digital signatures acceptable in markets around the world, the panel noted.

“The pandemic has not only forced corporate treasuries to adopt tools earlier than necessarily planned, such as electronic signing, but has also forced banks to standardise and ensure such tools are available for use on a global scale,” said Priyesh Patel, Treasury Operations, BHP.

Understandably, efforts to seamlessly mesh new technologies with legacy systems and dealing with insufficient data and related reconciliation issues can be the source of some frustration.

Sure enough, the discussion at ANZ’s expert roundtables centered on the merits of centralising treasury operations, harnessing the power of big data and the difficulties of making real-time payments work effectively with existing organisational processes and systems.

While acknowledging the many benefits of real-time payment systems, including enhancing the customer experience, panelists also pointed out that for these systems to fulfil their potential, the underlying treasury management and ERP systems also need to operate in real time.

The consensus view was while the ability to obtain real-time payment confirmations and data-rich inbound transactions are attractive features of new payment infrastructures, it will be some time before they are a standard market practice.

Treasurers also remain wary of an overreliance on technology and its limitations in addressing business continuity planning needs without a high level of due diligence. Efficient information dissemination remains a challenge, they pointed out, while noting even with sophisticated technologies, organisations can’t be overly reliant on predictive tools if the results are modelled based on the historical data.

Nonetheless, these challenges are not intractable and can be addressed with proper planning and introducing supplementary systems.

"Sense checks and the need for subjective decision-making should be built in to complement automated process where possible,” Singh said. “After all, cashflow forecasting can sometimes be more of an art than a science.”

At the same time, the panelists agree centralisation remains an integral part of the evolution of the treasury function and that this ground reality will drive the future adoption of sophisticated finance technologies.

The centralisation challenge

The final roundtable in ANZ’s series featured an open discussion on the experiences of the panelists in operating centralised or decentralised finance organisations, and the main pros and cons of each approach.

Centralisation, the experts agreed, must be a priority because it serves as a catalyst, helping organisations generate economies of scale and optimise outcomes for all stakeholders, especially when relying on technology to do away with manual processes and enhance operational efficiencies.

The roundtable also identified several salient points for companies to consider as they embark on the process of centralising their treasury operations. Among the most critical factors is to understand the drive to centralise must extend beyond core treasury functions to include related business areas such as accounts receivable, accounts payable, payroll, accounting and legal, the panel agreed.

Additionally, it was pointed out that standardisation is a prerequisite to achieving a centralised strategy with third-party service providers and aggregators playing a key role in maximising the benefits and ensuring the success of the centralisation effort.

Indeed, standards are a central building block to successfully digitising the treasury and it’s hard to progress without it. But for them to work, their use must be scaled up.

As James Brown, Head of Market Management, ANZ, noted, transactions need to reach a certain volume before businesses see the benefits.

“Once systems around the world, like SWIFT, trend towards one format, it’s like speaking one language, and we have a capable, standardised system,” he said. “This is, in a sense, one way of future-proofing treasury management.”

Overall, the trend is moving in the right direction as more companies adopt global standards, with ISO 20022 being a good example to illustrate this point. The digital payment standard is already widely used in Europe and is increasingly being adopted in Australia for both domestic and cross-border transactions.

When do you expect to start originating cross-border transactions in full ISO 20022 (using new elements and structures not available in MT)

Source: ISO 20022 in bytes: Adoption and how to prepare

As adoption rates grow, transaction volumes will eventually reach critical mass, tipping the systems that adhere to the standard into a virtuous cycle of greater adoption and continuous improvement. Eventually, other band-aid solutions built up over time to address limitations in infrastructure will no longer be necessary.

At the same time, for the centralisaton effort to be successful, the panelists on the ANZ roundtable agreed, organisations must consider issues from a locally oriented, or decentralised, perspective to develop comprehensive and effective solutions.

Furthermore, they reflected, the process of centralising business practices requires patience and a long-term vision that takes into account broader economic, political and technological factors. As one panelist remarked, “in some cases, the move to centralise has taken years if not decades to perfect”.

Ultimately, the discussion highlighted how centralisation and decentralisation each have a place within an organisation’s strategic dialogue - informed by the nature of the business - and treasury managers must take care to blend key elements from each approach in response to changing global circumstances and business priorities.

Most importantly, the panelists observed, while previous attempts to centralise the treasury have been largely defined by geographical considerations and the outsourcing of problems, future digital transformation efforts will be different.

Indeed, these will be driven by the easy availability and growing reliability of enterprise technologies and applications that enable enhanced decision-making through real-time data sharing and insights.

Analysing gaps, relying on partners

Clearly, digitising the treasury is an exercise fraught with challenges and one requiring long-term commitment from all stakeholders. Helping companies through this process are a host of third-party entities, including banks, technology providers and fintechs.

The panelists had some words of advice to help maximise the success of such partnerships: when engaging with third-party providers, the division of work and capacity for the business to release a level of organisational control must be considered, and companies must avoid an us-and-them mindset as that can be counterproductive.

"How you design, implement, and manage your treasury is a journey," Ellem said. "Though you need a vision and destination, you need to build the correct foundations so that as the business progresses along its journey, the structure enables evolution in response to the ever-changing business landscape, including new technologies and customer needs."

A realisation is growing among treasury managers and their banking partners that inaction could mean obsolescence. As a result, companies around the world are adopting various technological solutions and keeping a close watch on upcoming developments.

Along with the push for standardising e-signatures, other promising trends include the growing use of virtual accounts to improve cashflow management processes by better tracking incoming payments from major customers.

Blockchain is seen having the potential to revolutionise KYC compliance procedures. Treasurers are also turning to increasingly powerful predictive analytics tools that help mine fast-growing datasets and produce actionable intelligence.

Additionally, these tools are becoming more affordable and more widely used as they come embedded in software as a service (SaaS) applications as they allow for the integration of treasury operations in a more cost-effective and secure manner.

Given the range of products and solutions on offer and their varying levels of maturity, it’s easy to be distracted and confused by the buzzword bingo that has become a permanent feature of the contemporary technological landscape.

The ideal approach, therefore, is to perform a gap analysis that correctly identifies the merits and weaknesses of a treasury management system before selecting the technology best suited to address any problems while complementing the system’s strengths.

For BHP’s Singh, there are ways to best utilise the abundance of tools available.

“BHP’s treasury categorises products and services into three areas,” he said. “One, ‘Maintain’: tools needed for BAU activities; two, ’Modernise‘: updating existing applications; and three, ‘Transform’: tools and applications that can fundamentally change how things are done.”

Of course, digital transformation is an iterative process that can be enhanced through collaboration with trusted partners, including banks like ANZ, so treasury managers can stay up to date in a rapidly evolving space, and make the right choice for their organisation.

For Sean Pratt, Head of Banker Engagement, Institutional Transaction Banking, ANZ, there is no magic bullet.

“But the process starts with partners listening to treasurers to understand their end game, and working with them to provide the appropriate solution,” he said.

Related articles

-

True convergence of cross-border payments into the domestic rails in Australia is just around the corner.

2026-01-16 00:00 -

In 2026, the rapid acceleration in the adoption of digital will only get faster.

2025-12-09 00:00 -

Stablecoin will make a big bang in institutional real-time payments – but don’t expect it to replace cash, ANZ expert says.

2025-10-22 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.