-

Managing our changing natural environment is a pressing challenge for all businesses. For many, the obstacles in the way of a net-zero economy are becoming clearer than ever before – and importantly, so are many of the solutions.

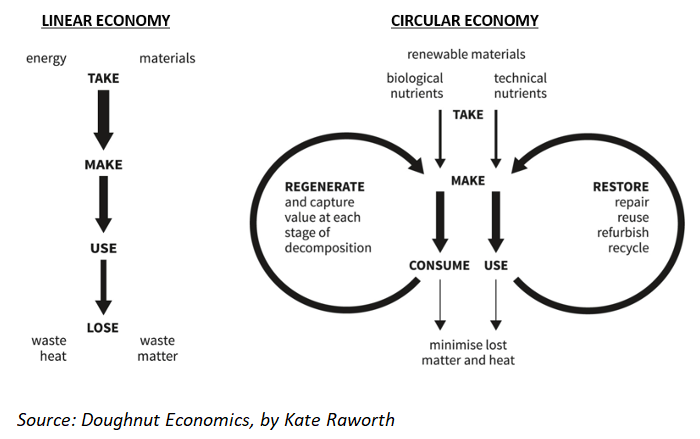

Amid the growing proliferation of decarbonisation activities, the concept of a circular economy looms as a simple way for business to understand the transition.

At Planet Ark’s Circularity conference in November, stakeholders from across industry, government, academia and NGOs came together to share their latest thinking. Three central obstacles underpinned that thinking: the broad challenges of climate change, biodiversity loss and toxic pollution.

The circular economy can help combat each of these challenges. Its animating principles – eliminating waste, circulating products (at their highest value) and regenerating nature - are increasingly being applied across many industries, and are under active consideration in others.

As manufacturers across several industries put greater emphasis on upstream design, the economy can begin to close the ‘materials loop’ and keep waste out of incinerators and landfill.

More than just a nice-to-have, circularity represents the kind of thinking required if the world is to meet the goals of the Paris Agreement.

With energy creating approximately 70 per cent of global emissions, according to the latest UN Emissions Gap Report, circular activities can plug the gap that the energy transition can’t fill alone. The rest must come from improved land and waste management, and circular principles being rolled out across food and manufacturing supply chains.

Opportunity, not obstacle

As the audience at Circularity were reminded by the former chief executive of Australia’s CSIRO, Larry Marshall, sustainability is “not a tax - it’s an opportunity for growth”.

A key part of ANZ’s climate and environment strategy is to support household, business and financial practices that improve environmental sustainability. As a bank, we know the right kind of financing can support many solutions on the path to net zero emissions. Decarbonisation activities, including leaning into renewable energy opportunities, optimising energy efficiency and embracing electrification, are top of mind for many businesses and their leaders.

Opportunities in nature supportive activities such as reforestation and pollution removal continue to grow. Vitally, circular economy activities, such as supporting the sharing, maintenance, reuse, refurbishment and recycling of products, continue to be an increasing area of focus.

Riding the wave

Embracing the circular model won’t be easy, but change is already happening. With businesses large and small rolling out circular economy solutions, the question is no longer ‘how do we catch the wave?’, but rather, ‘how do we ride it to prosperity?’.

Better commercialisation pipelines are crucial. The business community has an opportunity to work more closely with our world-leading scientists, ensuring research and innovation can be commercialised quickly and efficiently.

Some areas are easier to tackle than others. Plastic recycling and food waste are simple wins for businesses looking to meet public expectations around climate, nature and circularity.

These opportunities are more easily achieved when approached cooperatively. As the Circularity 2024 attendees were told, the world needs partnerships if the promise of circularity is to be achieved.

Make no mistake, there will be serious challenges along the way to a net-zero carbon, nature-positive and circular economy. But with the right solutions – and the right partners – opportunities for sustainable growth continue to emerge.

Holly Taylor is an Associate Director of Sustainable Finance at ANZ Institutional

Receive insights direct to your inbox |

Related articles

-

Incoming Aus taxonomy will help capital allocators put money towards the transition, institute chief says.

2024-12-03 00:00 -

Chinese growth has slowed, and many see similarities to Japan’s ‘lost decade’. But there’s another market showing similarities to that era – car making.

2024-11-07 00:00 -

China has put its foot down, but the EV opportunity still has some charge left in it yet.

2024-09-02 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.