-

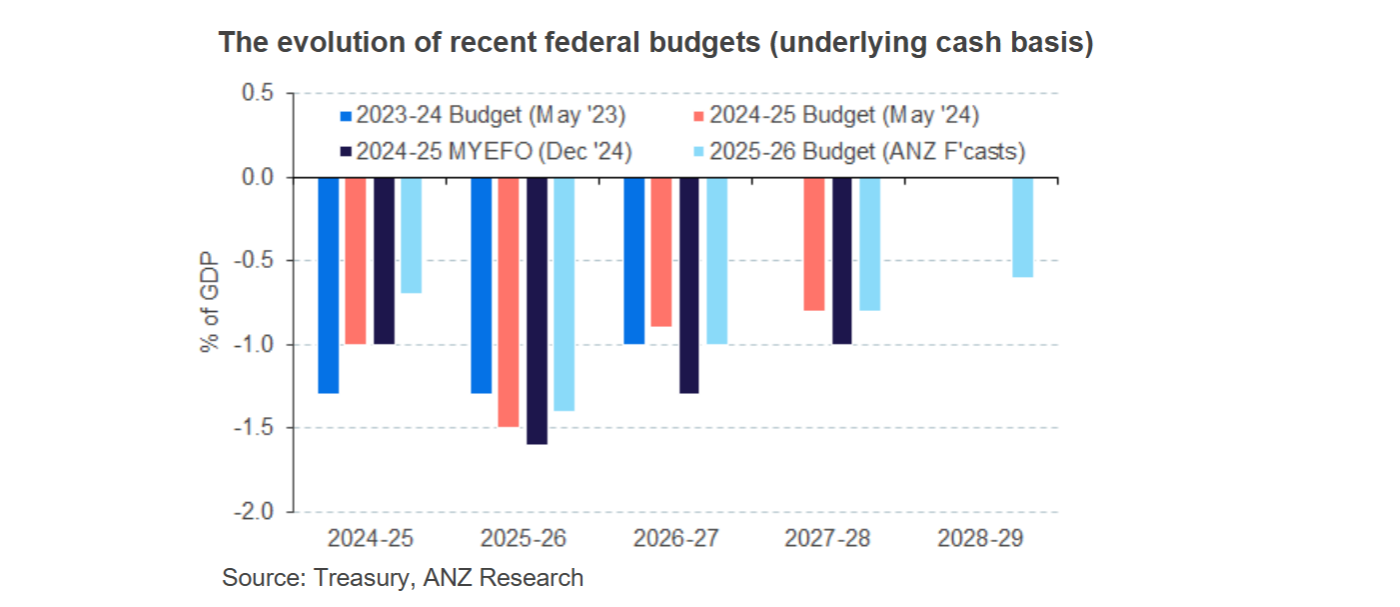

ANZ Research expects the 2025 Australian Federal Budget to show an underlying deficit of $A20 billion for 2024-25 and $A40 billion for 2025-26. The headline cash balance will likely be in deficit by around $A41 billion in 2024-25 and $A65 billion in 2025-26.

Underlying and headline deficits are likely through the forward estimates. ANZ Research views the monthly financial statements from the Department of Finance as showing a marked improvement in the fiscal position for 2024-25 relative to the Mid-Year Economic and Fiscal Outlook (MYEFO).

However, based on the profiling of the budget position in those statements, it looks like the departments of Treasury and Finance are likely to factor in less of an improvement in the budget starting point than ANZ Research would.

That conservative approach, combined with cost pressures across a range of programs and policy decisions, should offset stronger nominal gross domestic product growth in 2025-26.

This will produce budget forecasts for 2025-26 and beyond that show a modest improvement on those in the MYEFO, but similar to estimates in the 2024-25 budget.

Roll over

ANZ Research expect the 2025-26 Budget will contain additional net new spending of around $A2.5 billion in 2024-25, $A10 billion in 2025-26 and $A5 billion per year beyond that.

That would see a discretionary fiscal easing equivalent to around 0.25 per cent to 0.5 per cent of GDP in 2025-26. Such an amount would have no material impact on ANZ Research’s growth, inflation or Reserve Bank of Australia forecasts.

ANZ Research believes a rolling over of some cost-of-living relief measures could be a focus of this budget, as well as a possible allowance for future increases in defence spending. It is likely to also account for recent increases in health spending; and extensions to the Future Made in Australia package.

Adam Boyton is Head of Australian Economics at ANZ Research

This is an edited version of the ANZ Research report “2025-26 Australian Federal Budget Preview”, published March 18, 2025.

Receive insights direct to your inbox |

Related articles

-

ANZ’s Chief Economist says monetary policy won’t necessarily need to do all the work amid solid economic fundamentals.

2025-03-18 00:00 -

US tariffs on steel won’t impact Australia, but rising trade tensions could.

2025-03-13 00:00 -

Global easing environment around interest rates will continue amid uncertainty, ANZ Chief Economist says.

2025-03-06 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.