-

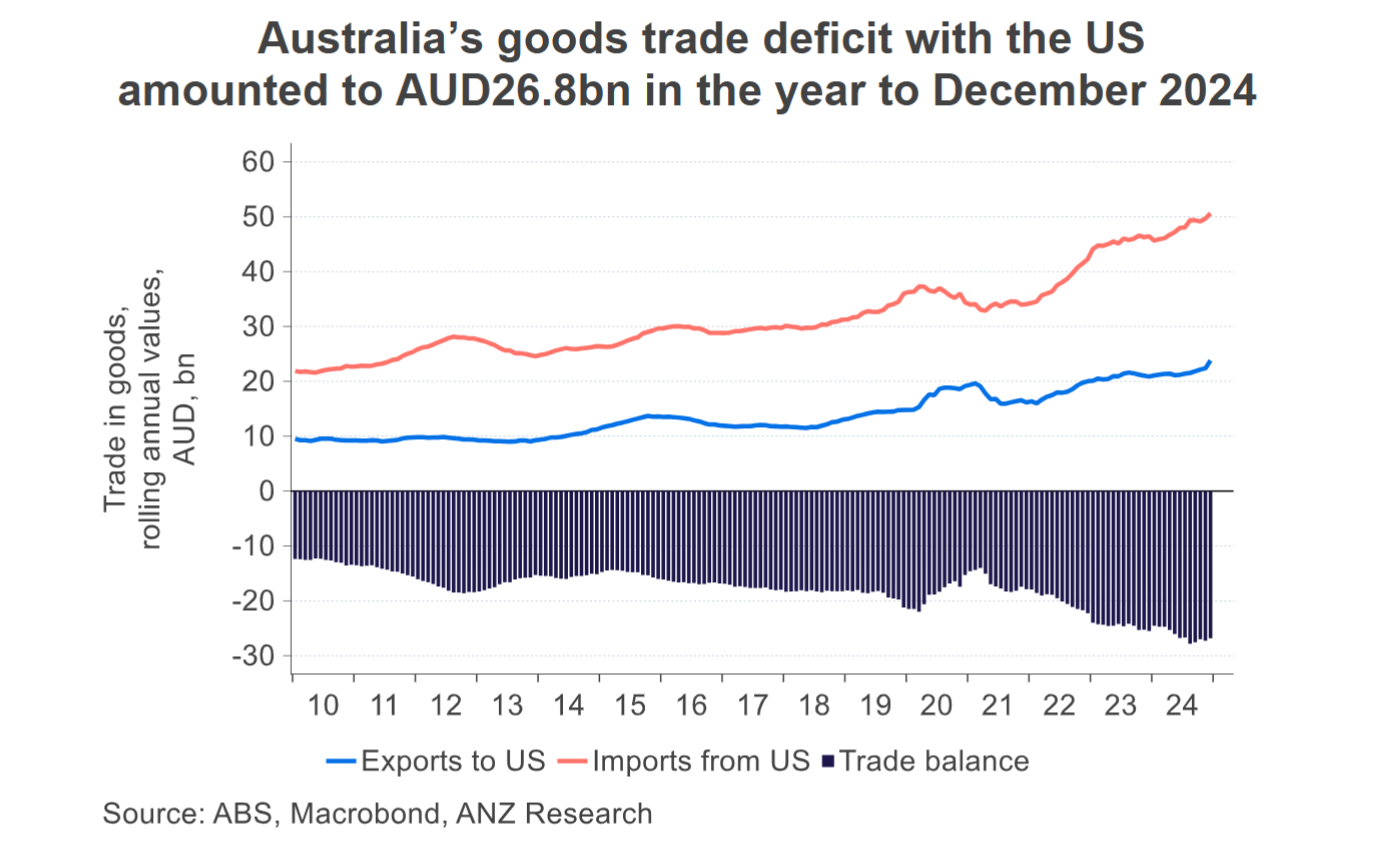

Trade policy in the United States is evolving, and the impacts of tariffs on the Australian economy are not yet clear. But Australia generally runs a large goods trade deficit with the US and is less likely to be a target for country-specific tariffs.

The recently announced 25 per cent tariffs on aluminium and steel imports into the US are likely to have minimal direct impact on Australia’s goods exports, in aggregate. Aluminium and steel exports to the US made up just 0.2 per cent of Australia’s total goods exports in 2024.

As a trade-exposed economy, the largest tariff-related risk for Australia arises from a potential escalation of trade tensions. On the more extreme end, a trade war could lead to supply-chain disruptions that increase the price of goods imports, negatively impacting domestic incomes and offsetting disinflation momentum.

But a trade war is not necessary for Australia to be impacted. The more likely outcome would be slightly lower global demand due to direct impacts of tariffs, combined with the impacts of uncertainty among business and consumers globally. This outcome would still be growth negative for Australia, although modestly so.

Tariffs

The US has implemented a 25 per cent tariff on all imports of aluminium and steel products from March 12. Aluminium is Australia’s tenth-largest goods export to the US.

In the year to December 2024, Australia exported $A7.2 billion of aluminium and steel globally. In that period, $A819 million, or 11.3 per cent, went to the US.

That accounted for 0.2 per cent of Australia’s total goods exports. By comparison, Australia’s largest export destination for these products is South Korea, which over the same period received $A1.4 billion, or 19.1 per cent of Australia’s total aluminium and steel exports.

Steel tariffs are unlikely to significantly impact Australian exports, in aggregate. The US has also indicated plans to impose a 25 per cent tariff on imports of pharmaceutical products. While the details are unclear at this stage, the aggregate impact is likely to be similarly small.

The US is the top export destination for Australia’s pharmaceutical products, taking 58.7 per cent ($A1.9 billion) in the year to December 2024. This accounted for 0.4 per cent of total goods exports over the same period.

Indirect

China is Australia’s largest trade partner, accounting for $A178.6 billion (6.6 per cent of nominal gross domestic product) of exports and $A110.3 billion (4.1 per cent of nominal GDP) of imports, in 2024.

On February 28, the US announced a 10 per cent tariff on imports from China. This followed a 10 per cent tariff increase announced in early February that raised the effective tariff level to 23 per cent.

These tariffs will weigh on China’s export revenue. If this leads to a downgrade in China’s economic activity it will soften demand for Australian exports, particularly commodities.

Historically, Australia’s commodity exporters have been able to redirect sales to other markets, but a softening in global demand from a downgrade in China’s growth would have a broader negative impact on commodity prices and the Australian dollar.

Recent downward movements in the $A have been largely driven by US trade policy uncertainty, which has dampened risk appetite. Lower sentiment towards China trade will also likely weigh on the $A.

A 25 per cent tariff on imported goods into the US from Canada and Mexico took effect on March 4, but those on goods compliant with existing agreements have been postponed until April.

Various countries that tax US imports have announced reciprocal tariffs, and there has been early commentary from the European Union regarding retaliatory tariffs due to proposed steel and aluminium tariffs from the US.

Likely event

In the likely event of slightly lower global and wide uncertainty, the impact to Australia would be mild. Downside risk to domestic business conditions is likely off the back of lower confidence, which has already started to occur locally.

Australia’s commodity income would decline as lower global demand from less business investment places downward pressure on prices. This fall in commodity incomes would be stronger if key trading partners such as China experience more sluggish investment as a result of tariffs.

Downward pressure on Australian exports would occur more broadly if a hit to business and consumer confidence (which is already evident in the US) flows through to more sluggish economic activity.

A depreciation of the $A from lower commodities income and risk-off sentiment globally, which would push import prices up and add upward pressure to tradables inflation. That would, however, also increase the competitiveness of other exports, which would soften the net impact.

Sophia Angala is an Economist and Adelaide Timbrell is a Senior Economist at ANZ

This story is an edited excerpt of the ANZ Research report “US tariffs on steel won’t impact Australia, but rising trade tensions could”, published March 11, 2025

Receive insights direct to your inbox |

Related articles

-

It’s important to recognise the advancements made in equality, while acknowledging the work still required.

2025-03-07 00:00 -

Global easing environment around interest rates will continue amid uncertainty, ANZ Chief Economist says.

2025-03-06 00:00 -

Asian corporates and financial institutions, traditionally reliant on US dollar and euro markets, are turning to Australia.

2025-03-03 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.