-

Australian consumer sentiment is expected to recover gradually through the rest of 2025 as inflation continues to ease. But with economic growth in the United States expected to be slower, the recovery in local sentiment could lag as well.

Tariff announcements from the US in the first half of 2025 have lifted global uncertainty and led to a downgrade in expectations of both US and global growth. ANZ Research has lowered its gross domestic product (GDP) forecast for the US in 2025 to just 1.5 per cent, on the back of elevated US recession risks it puts at around 40 per cent.

While the US’ proposed 10 per cent tariffs on Australian goods are expected to have limited direct impact on the Australian economy, the uncertain global backdrop is likely to influence consumers and businesses locally. This is likely to be the main impact of tariffs in Australia.

The response will be interesting to watch. ANZ Research expects the Reserve Bank of Australia (RBA) to cut the cash rate by 25 basis points at its May, July and August meetings in 2025, offsetting some of the downward pressure on consumer sentiment caused by weaker global growth. Outside the pandemic period, RBA rate moves have traditionally coincided with a pick-up in consumer sentiment.

Sentiment

While sentiment is primarily influenced by domestic factors, including the price level and changes in the cash rate, ANZ Research’s consumer sentiment model suggests US economic growth has a substantial impact — despite Australia’s relatively modest trade flows with the US.

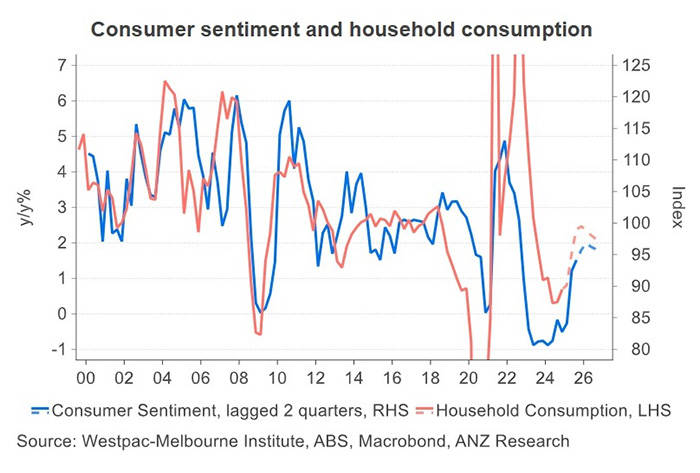

The model anticipates consumer sentiment will peak just below neutral (on a quarterly average basis), at 97, in the third quarter of calendar 2025 and end the year at 96.

Domestic factors, including stable inflation and ANZ Research’s forecast of three further RBA rate cuts in 2025, will put upward pressure on sentiment. The downgraded US economic outlook will weigh.

The model suggests a 0.1 percentage point decrease in quarterly US GDP growth has a similar effect on consumer sentiment as a 0.1 percentage point increase in quarterly domestic inflation. When confidence is lower, households might opt to allocate more income into savings and take fewer risks, all else equal.

This slower consumer sentiment recovery off the back of a downgrade in US growth implies household consumption growth of around 2 per cent leading into the fourth quarter of 2025. This is a little lower than ANZ Research’s forecast, which peaks at 2.5 per cent in the same period.

Aaron Luk is an Economist and Adelaide Timbrell is a Senior Economist at ANZ

This is an edited version of the ANZ Research report “Downgrade in US GDP expectations to weigh on Australian consumers”, published April 16, 2025

Receive insights direct to your inbox |

Related articles

-

Lower US dollar and lower US growth forecast amid tariff-driven uncertainty.

2025-04-17 00:00 -

Two economies indicate willingness for freer trade at a time when others are not.

2025-04-16 00:00 -

ANZ Research now expects the Reserve Bank of Australia to lower the official cash rate by 25 basis points in May, July and August.

2025-04-04 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.